Self Assessment Adjusted Net Income . According to my p60 my total pay for the year was £102,634.26. a basic understanding of adjusted net income: — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. — my main confusion is around adjusted net income. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. If you do not usually send a tax. From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs.

from www.sampleforms.com

— adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. — my main confusion is around adjusted net income. If you do not usually send a tax. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. a basic understanding of adjusted net income: According to my p60 my total pay for the year was £102,634.26.

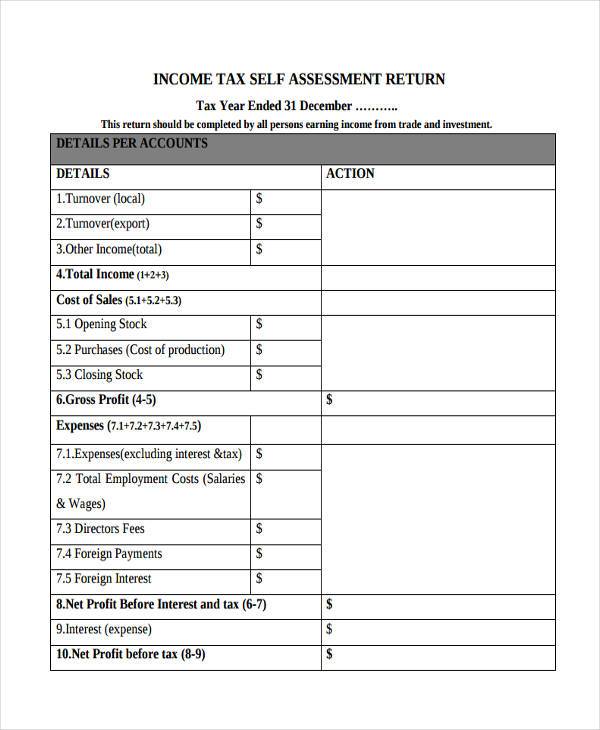

FREE 22+ Sample SelfAssessment Forms in PDF MS Word Excel

Self Assessment Adjusted Net Income — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. If you do not usually send a tax. — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. — my main confusion is around adjusted net income. a basic understanding of adjusted net income: According to my p60 my total pay for the year was £102,634.26. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs.

From cruseburke.co.uk

Adjusted Net Definition and How it Works CruseBurke Self Assessment Adjusted Net Income a basic understanding of adjusted net income: — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. According to my p60 my total pay for the year was. Self Assessment Adjusted Net Income.

From www.superfastcpa.com

What is Adjusted Net Self Assessment Adjusted Net Income a basic understanding of adjusted net income: If you do not usually send a tax. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. According to my. Self Assessment Adjusted Net Income.

From individuals.healthreformquotes.com

Schedule C 1040 line 31 Self employed tax MAGI instructions home office Self Assessment Adjusted Net Income — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. — my main confusion is around adjusted net income. According to my p60 my total pay for the year was £102,634.26. a basic understanding of adjusted net income: From april 2023, the threshold for submitting a self assessment increased. Self Assessment Adjusted Net Income.

From www.chegg.com

Solved 4a. Prepare the adjusted net that the Self Assessment Adjusted Net Income — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. — my main confusion is around adjusted net income. If you do not usually send a tax. According to my p60 my total pay. Self Assessment Adjusted Net Income.

From olap17.gitlab.io

Cool Net Balance Sheet Formula Profit And Loss Adjustment Self Assessment Adjusted Net Income — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. — adjusted. Self Assessment Adjusted Net Income.

From accotax.co.uk

Everything You Need to Know about Adjusted Net Self Assessment Adjusted Net Income From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce.. Self Assessment Adjusted Net Income.

From octaaccountants.co.uk

File Self Assessment Tax Return in the UK Octa Accountants Self Assessment Adjusted Net Income If you do not usually send a tax. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. According to my p60 my total pay for the year was £102,634.26. —. Self Assessment Adjusted Net Income.

From www.paretolabs.com

How to Find Net for Beginners Pareto Labs Self Assessment Adjusted Net Income — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. If you do not usually send a tax. According to my p60 my total pay for the year was £102,634.26. — adjusted net income is the total income that can be taxed which includes. Self Assessment Adjusted Net Income.

From www.sec.gov

GRAPHIC Self Assessment Adjusted Net Income — my main confusion is around adjusted net income. — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. If you do not usually send a tax. a basic understanding of adjusted net income: From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax. Self Assessment Adjusted Net Income.

From slidesdocs.com

SelfEmployed Analysis Comprehensive Evaluation For Financial Self Assessment Adjusted Net Income From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. a basic understanding of adjusted net income: — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is. Self Assessment Adjusted Net Income.

From templatelab.com

27 Statement Examples & Templates (Single/Multi step, Proforma) Self Assessment Adjusted Net Income From april 2023, the threshold for submitting a self assessment increased to £150,000 per tax year. — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. According to my p60 my total pay for the year was £102,634.26. you’ll also need to do a. Self Assessment Adjusted Net Income.

From milheratl06materialdb.z13.web.core.windows.net

How To Calculate Self Employment Net Self Assessment Adjusted Net Income — my main confusion is around adjusted net income. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. — adjusted net income is the total taxable. Self Assessment Adjusted Net Income.

From biz.libretexts.org

4.5 Prepare Financial Statements Using the Adjusted Trial Balance Self Assessment Adjusted Net Income — my main confusion is around adjusted net income. a basic understanding of adjusted net income: you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. . Self Assessment Adjusted Net Income.

From www.chegg.com

Solved 4a. Prepare the adjusted net that the company Self Assessment Adjusted Net Income If you do not usually send a tax. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. According to my p60 my total pay for the year was. Self Assessment Adjusted Net Income.

From www.sampleforms.com

FREE 29+ Sample Blank Assessment Forms in PDF MS Word Excel Self Assessment Adjusted Net Income — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and therefore individual pension contributions will reduce. — adjusted net income is the total taxable income, before any personal. Self Assessment Adjusted Net Income.

From www.sec.gov

Q2 Fiscal 2017Reconciliation of Net to Adjusted EBITDA ( in Self Assessment Adjusted Net Income a basic understanding of adjusted net income: — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. From april 2023, the threshold for submitting a self assessment increased. Self Assessment Adjusted Net Income.

From projectopenletter.com

When Do You Have To Fill In A Self Assessment Tax Form Printable Form Self Assessment Adjusted Net Income — adjusted net income is the total taxable income, before any personal allowances and less certain tax reliefs. — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000.. Self Assessment Adjusted Net Income.

From www.sampleforms.com

FREE 22+ Sample SelfAssessment Forms in PDF MS Word Excel Self Assessment Adjusted Net Income — adjusted net income is the total income that can be taxed which includes your personal allowance and without tax reliefs. you’ll also need to do a self assessment tax return if your adjusted net income is above £150,000. — adjusted net income is used to determine whether the allowance is given at £1,000 or £500 and. Self Assessment Adjusted Net Income.